Company Overview

Jared Isaacman founded Shift4 Payments in 1999 when he was just 16 years old! That's right, he was still a teenager (though he had already earned his high school diploma and was working full-time). He worked at a payment processing company called MSI Merchant Services Inc. and noticed some inefficiencies in the industry. He saw an opportunity to do things better, so he took the leap and started his own company, initially called United Bank Card, in his parents' basement.

Isaacman's company stood out by making things easier for merchants. At the time, setting up a payment system could take a month, and require a lengthy application, and merchants even had to pay for their credit card readers. United Bank Card simplified the process with faster setup, reducing setup time to one day; providing free credit card readers, and implementing a simpler, two-page, application.

This focus on making things easier for merchants was a key to their early success.

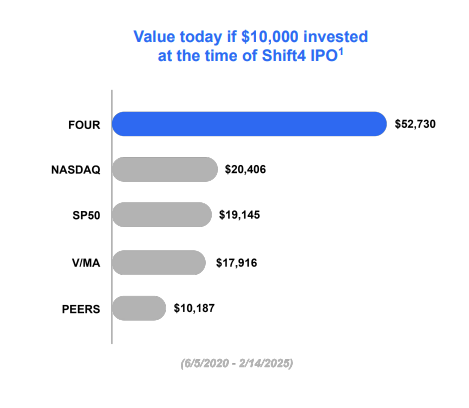

In June 2020, Shift4 went public on the New York Stock Exchange under the ticker symbol "FOUR." It was a successful IPO, raising $345 million. Interestingly, they were the first company to ring the opening bell at the NYSE after the trading floor reopened following its pandemic shutdown.

The Business Model

In simple terms, Shift4 acts as a middleman, connecting businesses with the complex world of electronic payments. They act as a bridge between businesses and the financial institutions that handle transactions. They provide the technology and services that allow businesses to accept credit and debit cards, while working behind the scenes with card networks and banks to ensure that transactions are processed smoothly and securely.

Here's a breakdown of their role in the payment process:

Merchant Services: The tools and services merchants need to accept electronic payments from their customers. This includes:

Payment Gateway: Shift4 offers a unified (omnichannel) payment platform. This means they can handle both online and physical point-of-sale (POS) transactions through a single, integrated system.

Payment Processor: Shift4 handles the technical aspects of the transaction, such as authorizing the card, clearing the funds, and settling the payment.

Merchant Account: A type of bank account that allows businesses to accept credit and debit card payments.

Third-party integrations: Shift4 enables integrations into complementary third-party applications, which helps reduce the number of vendors on which the merchants rely. For example, a restaurant can enable Uber Eats via Shift4 and accept orders from their existing POS.

Transaction Processing: When a customer makes a purchase using a credit or debit card, Shift4 facilitates the transaction by:

Authorizing the Transaction: Verifying with the customer's bank (the issuing bank) that the card is valid and has sufficient funds.

Clearing the Funds: Transferring the funds from the customer's bank account to the merchant's bank account (the acquiring bank).

Settling the Payment: Ensuring that the merchant receives the funds for the transaction.

Naturally, this brings the question of what their relationship with the credit card issuers (Visa and Mastercard) is and with the banks.

Relationship with credit card issuers:

Card Networks: Visa and Mastercard are card networks that set the rules and infrastructure for credit and debit card transactions. Shift4 works with these networks to process transactions.

Interchange Fees: Shift4, along with the merchant's bank, pays interchange fees to the card networks for each transaction. These fees help cover the costs of maintaining the card network.

Relationship with banks:

Issuing Banks: These are the banks that issue credit and debit cards to customers. Shift4 interacts with issuing banks to authorize transactions and clear funds.

Acquiring Banks: These are the banks that hold merchant accounts for businesses. Shift4 works with acquiring banks to settle payments and ensure that merchants receive their funds.

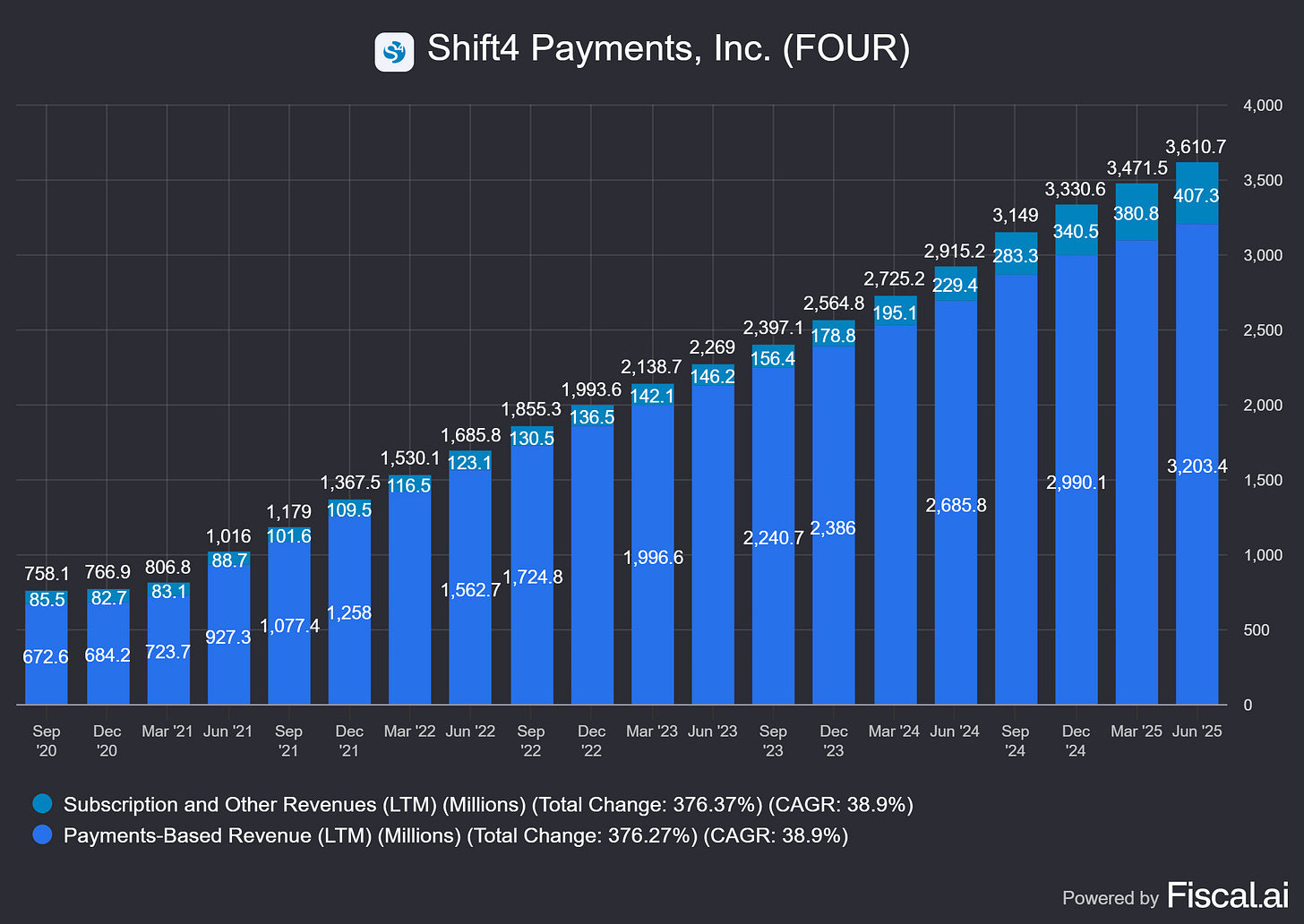

Knowing their role in payment processing, we can now examine Shift4's revenue streams. These include:

Transaction fees: Shift4 charges a small fee for each transaction processed through its system. This fee is a percentage of the total transaction amount, and it is directly paid by the merchant and indirectly by the end customer, as it is included in the overall price of the goods or services purchased.

Software and services: Shift4 also offers a variety of software and services to businesses, such as point-of-sale systems, online payment gateways, and fraud prevention tools. These products and services are typically sold on a subscription basis or for a one-time fee.

Hardware sales (included in Subscription and other revenues below): Shift4 also sells hardware to businesses, such as credit card terminals and barcode scanners.

Due to its business model, Shift4's revenue is predominantly recurring. The company's merchant base is well diversified, with no single merchant accounting for more than 3% of the revenue.

For merchant acquisition, Shift4 uses a combined direct and indirect sales model. It sells directly to large enterprise clients through its internal sales team and partners with independent software vendors and resellers, who bundle Shift4's payment solutions with their own offerings and sell to smaller and medium-sized businesses.

Shift4 doesn't publicly disclose the exact breakdown of its mix of merchant base by industry. However, we can glean some insights from other publicly available sources. Shift4 has a particularly strong presence in certain industries, including:

Hospitality: This includes luxury resorts, hotels, and other lodging establishments.

Food & Beverage: This encompasses restaurants, bars, and other food service businesses.

Retail: This includes a variety of retail stores, both brick-and-mortar and online.

Sports & Entertainment: This includes stadiums, arenas, and other entertainment venues.

Airlines & Travel: This includes airlines, airports, and other travel-related businesses.

Unfortunately, Shift4 also doesn't publicly disclose their exact merchant retention rate. It's reasonable to assume that they maintain a healthy retention rate given their strong growth, and focus on customer support.

Quality of Management

At the time of this writing, Shift4 is still a founder-led company but is about to change very soon.

After 26 years leading Shift4, Jared Isaacman is stepping down. In December 2024, he was nominated to be the next NASA Administrator. He is transitioning his Shift4 responsibilities to Taylor Lauber. Taylor has a strong financial background from Blackstone and Merrill Lynch and has been with Shift4 for seven years. His leadership remains to be seen.

Even after his departure, Jared Isaacman will still control approximately 76% of Shift4's voting power. His interest in the company's well-being and growth is far from over.

Does the company have a sustainable competitive advantage?

Shift4's closest claim to a unique competitive advantage lies in their combination of deeply integrating payment solutions, and deep vertical expertise, particularly within the hospitality and related sectors.

Why this combination is hard to replicate:

Requires significant investment: Building deep integrations and vertical expertise takes time and resources. It's not something easily copied overnight.

Network effects: The more integrations Shift4 has, the more attractive their platform becomes to merchants and software providers. This creates a virtuous cycle.

Industry knowledge: Understanding the specific needs of different verticals requires specialized knowledge and experience.

Switching costs: The switching costs associated with leaving Shift4 can be substantial, including contractual obligations, integration costs, data migration, training, and operational disruptions.

Is the Company active in an attractive end market?

Shift4 Payments operates in a very attractive end market. The electronic payments industry is experiencing significant growth and offers substantial opportunities. Here's why:

Secular shift to electronic payments: The world is moving rapidly away from cash and towards electronic forms of payment. This trend is driven by convenience, security, and the rise of e-commerce. This fundamental shift creates a large and expanding market for payment processing services.

E-commerce growth: The continued growth of e-commerce is a major tailwind for payment processors like Shift4. Online transactions require secure and reliable payment gateways, and Shift4 is well-positioned to capitalize on this growth.

Increasing complexity of payments: As payment methods become more diverse (e.g., mobile wallets, contactless payments), the need for sophisticated payment processing solutions increases. Shift4's ability to handle a wide range of payment types is a significant advantage.

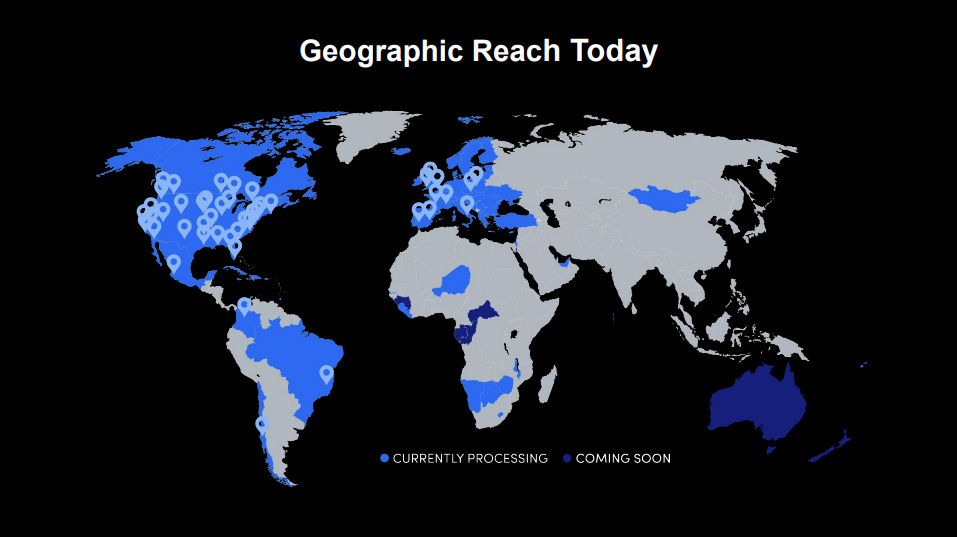

Global expansion: The global nature of the payments industry offers significant growth opportunities. Shift4's recent acquisitions and expansion efforts demonstrate their ambition to tap into international markets.

In summary, Shift4 operates in a large, growing, and dynamic market with significant tailwinds. The shift to electronic payments, the expansion of e-commerce, and the increasing complexity of payment methods all contribute to the attractiveness of this end market.

What are the main risks for the company?

Substantial and increasingly intense competition: The financial services, payments, and payment technology industries are highly competitive. Shift4 competes against various businesses with varying roles within the payments value chain. Rapid and significant changes in technology, including products and services that enable payment networks and banks to transact with consumers directly; new entrants that have developed alternative payment systems, and other market developments may negatively affect Shift4’s overall business and operation.

Overall level of consumer spending: The majority of Shift4’s revenue is dependent on consumer spending behaviors. A reduction in the amount of consumer spending or credit/debit card transactions could result in a decrease in Shift4’s revenue and profits.

Acquisitions of businesses: Shift4 Payments has been quite active on the acquisition front in recent years, Vectron Systems AG (July 2024), Givex (October 2024), Card Industry Professionals (December 2024), Global Blue (Announced February 2025), to name a few. Acquisition risks include valuation risk (determining a fair price for the business); integration risk (managing the process of integrating the acquired business’ people, products, and technology); regulation risk (obtaining regulatory approvals), and due diligence (identifying undisclosed or unknown liabilities or restrictions to be assumed in the acquisition).

Thanks for reading!

Stiliyan Loukanov, Feather Fund

Open an account with Interactive Brokers:

https://ibkr.com/referral/stiliyan756

Sign up to Revolut with the link below to support the blog:

ttps://revolut.com/referral/?referral-code=stiliyujwu!MAY1-24-AR

Open an account with eToro to support the blog:

Disclaimer: The information presented here, including ideas, opinions, views, predictions, forecasts, commentaries, or suggestions, whether explicitly stated or implied, is intended purely for informational, entertainment, or educational purposes. None of the content should be interpreted as personalized investment or financial advice. Although every effort has been made to ensure the accuracy of the information provided, errors or inaccuracies may be present. Always exercise caution and seek professional financial advice before making any investment decisions.