Company Overview

Paychex was founded in 1971 by Blase Thomas Golisano (a son of Sicilian immigrants from West Irondequoit, New York). He served as president and Chief Executive Officer from 1971 to October 2004.

The concept for Paychex (initially established as Paymaster) originated when Golisano was a salesman in the payroll processing sector for EAS (Electronic Accounting Systems).

At the time, it was an industry-wide belief that payroll services were viable only for large companies (with fifty or more employees). Before Golisano, no one had ever thought to challenge that principle even though approximately 95% of businesses in America had fewer employees.

Golisano saw the immense market opportunity and took it. He figured out a way to deliver payroll services to this market at a price these small businesses could afford.

In February 2020, Golisano released Built, Not Born: A Self-Made Billionaire's No-Nonsense Guide for Entrepreneurs. You can find more interesting facts about Paychex's early days and Golisano’s endeavours in the book.

Nowadays, Paychex is an industry-leading provider of cloud-based Human Capital Management (HCM) solutions, delivering a full suite of technology and advisory services in human resources (HR), employee benefit solutions, insurance, and payroll, for small- and medium-sized businesses throughout the U.S. and parts of Northern Europe (Germany and Denmark). The company serves approximately 740,000 business clients in the U.S. and Europe and pays one out of every 12 American private sector employees.

The Company also has operations in India. Paychex India's office started small through the acquisition of Nettime Solutions in 2014 and houses information technology, service, and sales support functions.

Paychex earned recognition as one of the World’s Most Ethical, Admired, and Innovative Companies by Ethisphere and Fortune. Additionally, the company has been recognised as the largest 401(k) recordkeeper in the U.S. by PLANSPONSOR magazine for ten consecutive years.

The business model or how the company makes money?

“From hire to retire”

Paychex supports small- and medium-sized businesses with HR solutions, from do-it-yourself payroll to comprehensive HR outsourcing.

Paychex offers a wide range of solutions – including the aforementioned HR outsourcing, HCM technology, payroll processing, retirement and insurance solutions.

The key features of their services are:

Management Solutions, comprised of the following: i) HCM Technology: Paychex Flex - the HCM SaaS platform that unites HR, payroll, time and attendance, and benefits processes; ii) HR and compliance professionals: approximately 950 experts who provide regulatory compliance solutions, retirement solutions administration, HR administration and other HR support.

Primary drivers of the revenue stream for this segment of the business: i) increase in the number of clients and clients’ employees (Paychex offers clients three payroll plans—Paychex Flex Essentials, Paychex Flex Select and Paychex Flex Pro); ii) pricing realisation leading to higher revenue per client; iii) growth in HCM ancillary services.

Professional Employer Organisation (PEO) and Insurance Solution:

i) a PEO is a type of full-service human resource outsourcing known as co-employment. In this arrangement, the PEO performs various employee administration tasks, such as payroll and benefits administration, on behalf of a business; ii) through its licensed insurance agency, Paychex Insurance Agency, Inc., Paychex provides insurance, allowing employers to expand their employee benefits and corporate offerings.

Primary drivers of the revenue stream for this segment of the business: i) increases in the average wages per employee; ii) increases in the premiums for unemployment and health insurance.

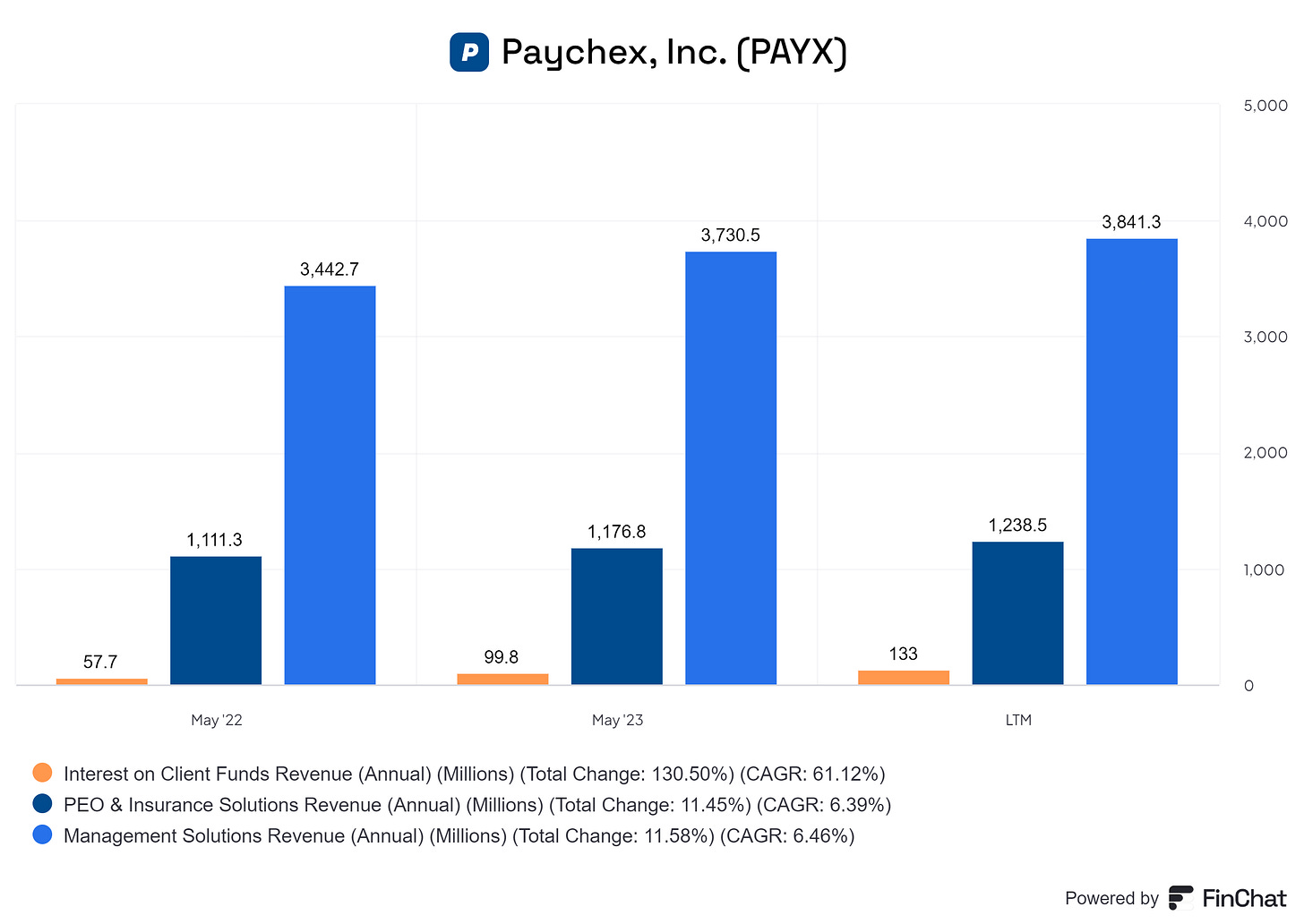

Another source of income for Paychex is the interest that the company collects from funds held for clients. For fiscal 2023 they have collected $99.8 million from interests, reflecting an increase of 73% compared to 2022.

The primary driver of the revenue stream for this segment of the business is the interest rate hikes.

Paychex markets and sells its solutions and support through its direct sales force channel (sales representatives) and its virtual sales force channel (a small team that sells in areas without a direct sales force presence).

However, more than 50% of Paychex's new small-market payroll clients come from its indirect sales channels, in other words, its various referral programs, more specifically:

Paychex Referral Network Program: focused on existing clients.

Paychex Partner Program: focused on certified public accountants (over half of U.S. CPA firms are enrolled in the program). The company also has a long-standing partnership with the American Institute of Certified Public Accountants (“AICPA”) as the preferred payroll provider for its AICPA Business Solutions Program. The current partnership agreement with the AICPA is in place through September 2025. The partnership has been renewed repeatedly over the years.

and

Paychex Bank Partnership Program: focused on banks and credit unions.

Paychex utilises service agreements and arrangements with clients that generally do not contain specified contract periods and may be terminated by either party with 30 days' notice of termination. Nevertheless, Paychex’s client retention rate is consistently above 80%.

Quality of management and alignment of interests

"Show me the incentives, and I will show you the outcome" - Charlie Munger

John B. Gibson, Jr. assumed the role of president and chief executive officer in October 2022. Under Gibson’s leadership, Paychex has continued to innovate and grow. The company reported a record $5 billion in revenue at the close of fiscal year 2023.

Bringing more than 20 years of experience in HR solutions, technology, and business services, Gibson joined Paychex as senior vice president of service in May 2013. In that role, Gibson led the service organisation to record customer satisfaction and retention. He was instrumental in the company’s international expansion and in growing Paychex’s digital payroll and professional employer organisation (PEO) businesses.

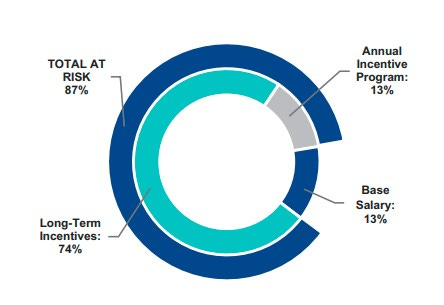

Paychex’s executive compensation program is designed to ensure that the interests of the senior leaders are appropriately aligned with the Company’s stockholders.

A significant portion of the annual compensation is “at risk” based on performance. The pay mix for Mr Gibson, for fiscal 2023, was as follows:

Does the company have a sustainable competitive advantage?

It is not an easy job to assess whether Paychex has a competitive advantage. However, there are a few factors that may lead to the conclusion of a moat, one of them being the margins, but more on that later.

Here is what we found in search for Paychex's moat, outside the margins:

Brand Recognition: Paychex is widely recognised and trusted within the HCM industry.

Switching Costs: There are significant switching costs in terms of effort, time, and psychological impact when considering a move to a competitor.

Data Network Effect: As more clients use Paychex’s products, they contribute more data, which in turn enhances the intelligence and effectiveness of Paychex’s offerings. This improvement can manifest in various ways, such as core performance enhancements, personalised recommendations, and more.

Referral Program Network Effect: By incentivising current clients and industry experts to refer others, Paychex leverages word-of-mouth marketing to drive growth. Referral programs not only reduce customer acquisition costs but also boost margins.

Furthermore, Paychex is doing its best to stay ahead of the competition. The company continues to make investments in leading-edge technology, artificial intelligence and the self-service capabilities of its platform.

Is the company active in an attractive end market?

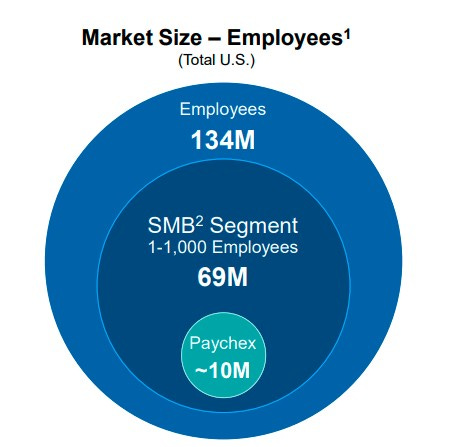

We believe Paychex operates in a significantly under-penetrated and growing market, with untapped potential to expand within its existing target markets.

Exclusively within the U.S., the company has accessed a substantial share of the small and mid-sized business sector, engaging around 10 million employees. This figure accounts for roughly 14% of its potential market of 69 million small and mid-sized business employees. This sector is expansive and on the rise, valued at over $90 billion and experiencing annual growth of 5-7%.

Paychex is not just growing within the U.S.; it has also expanded into other regions around the globe.

What are the main risks for the company?

Competition: the market for HCM services is highly competitive and fragmented. Paychex has one primary national competitor (AMD), furthermore, it competes with other national, international, regional, local, and online service providers. In addition to traditional payroll processing and HR service providers, the company compete with in-house payroll and HR systems and departments.

Technological Disruption: the market for Paychex solutions is characterised by rapid technological advancements, changes in customer requirements and frequent new product introductions. As new technologies (such as AI) continue to emerge, they may be disruptive to the HCM industry.

Termination of AICPA partnership agreement: The company has a long-standing partnership with the Institute and the certified public accountants who graduate there. More than 50% of Paychex’s new small-market payroll clients come from these referral sources. We assess as a significant risk a situation in which the partnership is terminated.

Cyberattacks, security vulnerabilities and privacy data leaks: could negatively affect Paychex's ability to attract new clients, cause existing clients to terminate their agreements, result in reputational damage, and lead to lawsuits, regulatory fines, or other actions or liabilities.

Economic slowdown: a slowdown in the economy or other negative changes, including in employment levels, the level of interest rates or the level of inflation, may harm the business.

In the upcoming section, we delve into an exploration of Paychex's financial health, its capacity for generating profits, and its current valuation level.

Stiliyan Loukanov, Feather Fund

Sign up to Revolut with the link below to support the blog:

ttps://revolut.com/referral/?referral-code=stiliyujwu!MAY1-24-AR

Open an account with eToro to support the blog:

Disclaimer: It’s important to note that we hold in our portfolio the company mentioned. The information presented here, including ideas, opinions, views, predictions, forecasts, commentaries, or suggestions, whether explicitly stated or implied, is intended purely for informational, entertainment, or educational purposes. None of the content should be interpreted as personalized investment or financial advice. Although every effort has been made to ensure the accuracy of the information provided, errors or inaccuracies may be present. Always exercise caution and seek professional financial advice before making any investment decisions.