I Am a Sinner

The Seduction of Short-Term Gains

I messed up. I broke my own investing rules. I was supposed to hold onto my investments for the long term, but I got caught up in trying to make quick money. The market was going up fast, and I started to worry. I was scared that the market would suddenly crash and I'd lose all the money I had made. This fear made me want to sell some of my stocks and take my profits.

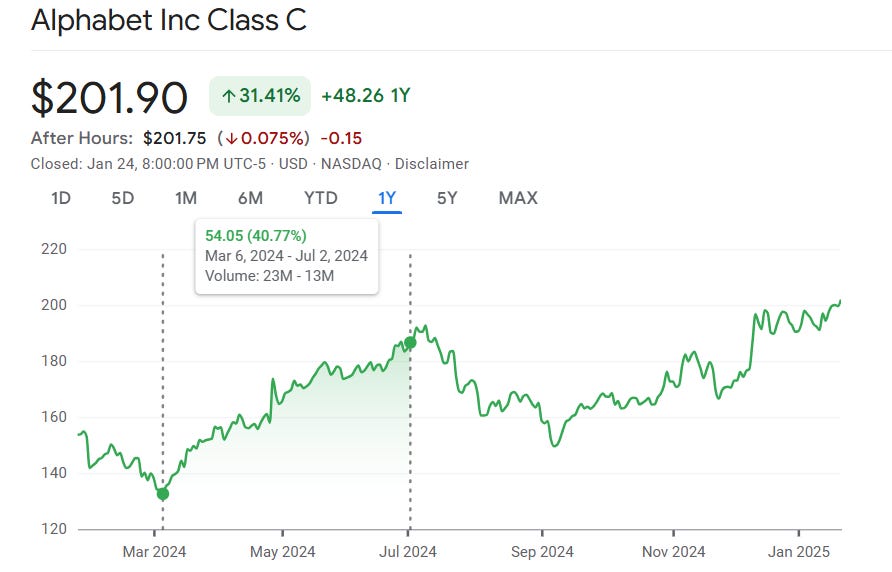

At my imaginary Feather Fund, I adhere to a quality investing philosophy. This means focusing on identifying and investing for the long run in exceptional companies with strong and enduring competitive advantages. However, I have lost sight of one key component of this philosophy: “for the long run.” For example, last year I bought shares of Alphabet, and it quickly surged by nearly 40% and I got scared and sold.

This pattern repeated with Booking Holdings, which also experienced a significant rise.

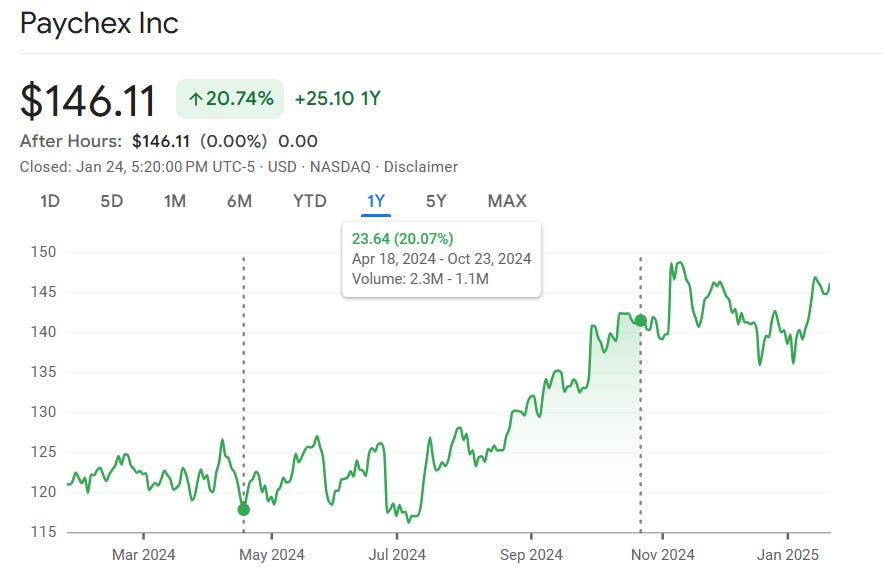

Another instance involved Paychex, which I purchased and subsequently sold after a 20% gain, scared that it had become overpriced and a correction was imminent.

These seemingly successful trades were a cruel illusion, camouflaging the underlying risk and undermining my long-term investment strategy.

My trading wasn't always about locking in gains, often it involved impulsive decisions. Sometimes I impulsively bought a stock simply because it had fallen sharply during the day. The next morning, I'd often wake up regretting the purchase and quickly sell it. These impulsive actions, driven by emotions rather than reason, eroded my discipline and once again undermined my long-term investment goals.

I'm learning from my mistakes and I'm committed to returning to a disciplined, long-term focused investment approach that aligns with Feather Fund's core philosophy of quality investing for the long run. To do that I will:

Create a more disciplined investment environment by holding my readily available cash in a separate, dedicated account. This will require an extra step before making any investments – transferring funds from my cash account to the investment account.

Implement a "trimming" strategy for profitable positions, such as selling a small percentage of shares in companies that have appreciated significantly in a short time.

Reduce the frequency of my portfolio reviews to minimize the temptation to react to short-term market fluctuations.

I decided to write this down because I believe in the importance of transparency and honesty. Sharing my experiences, both successes and failures, is crucial for personal growth and can hopefully offer valuable insights to others. I'm sure that out there in the vast world of investing, other retail investors have also struggled with the temptation of short-term trading and the allure of quick gains. By sharing my story, and openly acknowledging my mistakes, I hope to help others avoid falling into the same traps and ultimately achieve greater success in their investment journeys.

Thanks for reading!

Stiliyan Loukanov, Feather Fund

Open an account with Interactive Brokers:

https://ibkr.com/referral/stiliyan756

Sign up to Revolut with the link below to support the blog:

ttps://revolut.com/referral/?referral-code=stiliyujwu!MAY1-24-AR

Open an account with eToro to support the blog:

Disclaimer: The information presented here, including ideas, opinions, views, predictions, forecasts, commentaries, or suggestions, whether explicitly stated or implied, is intended purely for informational, entertainment, or educational purposes. None of the content should be interpreted as personalized investment or financial advice. Although every effort has been made to ensure the accuracy of the information provided, errors or inaccuracies may be present. Always exercise caution and seek professional financial advice before making any investment decisions.