cBrain A/S

An In-Depth Analysis of the Business Model

• Company name: cBrain A/S

• ISIN: DK0060030286

• Ticker: CBRAIN

• Stock Price: 187 DKK

• Market cap: 3.80B DKK

• Average daily volume: 20.05K

• Stock Style: Small-Growth

Executive Summary

cBrain is a Danish software company that has established a highly differentiated and profitable business model by pioneering the "Commercial Off-the-Shelf" (COTS) approach for public sector software. This model represents a strategic departure from the traditional, bespoke government IT projects that are often characterized by long implementation cycles, cost overruns, and limited scalability. The company's core product, the F2 platform, is a standardized yet highly configurable solution for case and document management, enabling rapid digital transformation and significantly "closing the time gap" from political decision to execution.

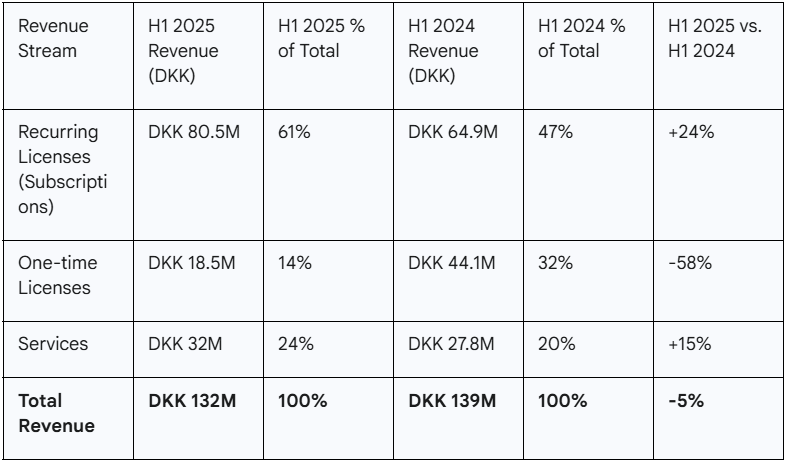

The company's financial profile indicates a business in a healthy and deliberate transition. In 2024, cBrain reported a robust earnings before tax (EBT) margin of 32% on revenue of DKK 268 million, demonstrating high operational efficiency. A key strategic pivot is evident in its revenue mix: in the first half of 2025, recurring revenue from subscriptions constituted 61% of total revenue, a substantial increase from 47% the prior year, while services revenue also grew by 15%. This trend signals a shift toward a more predictable and stable Software-as-a-Service (SaaS) model.

cBrain's strategic direction is anchored in a dual go-to-market approach that balances its core business with existing "super accounts" and ambitious international expansion into high-growth, category-defining niches. The company's expansion is not a scattershot approach but is focused on leveraging its proven success in Denmark, which has been ranked first in the UN E-Government Survey since 2018, as a powerful reference point. The strategic niches, such as "Paperless Ministry" and "Environmental Permitting," allow cBrain to apply deep expertise to solve specific, complex problems on a global scale.

The business model, while fundamentally sound, is not without its risks. The company openly acknowledges that its revenue is susceptible to short-term volatility due to delays in large government procurement schedules. Competition from larger, well-established players like Tyler Technologies, with its extensive installed base, and other nimble, modern competitors like Objective Corporation presents a constant challenge. Despite these factors, the global trend towards COTS for government provides a significant tailwind, positioning cBrain as a first-mover with a high potential for sustained, long-term growth by leveraging its product's scalability and its strategic focus.

I. Introduction to cBrain and Its Market Context

cBrain is a Danish software company, founded in 2002 and headquartered in Copenhagen, Denmark, with a clear and focused mission: to empower governments on their journey toward modernization and digital transformation. The company is publicly listed on the NASDAQ OMX Nordic exchange under the symbol CBRAIN. Its foundational belief is that digitization is not merely a technological upgrade but a critical enabler for a new generation of strong, efficient, transparent, and accountable public institutions.

To understand cBrain's business model, it is essential first to recognize the profound paradigm shift occurring in the government technology, or "GovTech," market. Historically, public sector IT was defined by lengthy, complex, and high-cost bespoke projects. These projects often involved extensive custom development to meet the unique and specific needs of each government agency, leading to prolonged implementation timelines, budget overruns, and vendor lock-in. The result was often a fragmented digital infrastructure that struggled to keep pace with evolving public demands and legislative changes.

cBrain’s business model is a direct response to this legacy approach. The company explicitly positions itself as a leader in the fast-emerging global market for COTS software for governments. This strategic positioning is not just a marketing slogan; it represents a fundamental philosophical and operational divergence from the traditional model. By providing a standardized, pre-built platform, cBrain aims to "challenge the dominance of traditional suppliers" and capitalize on a market that is increasingly recognizing the efficiency and cost-effectiveness of standardized solutions. This shift provides the macro-economic context for why cBrain's approach is both innovative and strategically timed to capture a significant market opportunity.

II. The Foundational COTS Business Model

Defining the COTS for Government Model

The cornerstone of cBrain's business model is its pioneering application of the COTS principle to the public sector. This approach is a strategic departure from the traditional model of building custom software for each government client. Instead, cBrain provides a single, fully integrated, standardized platform—the F2 platform—that is pre-built and purpose-built for government work. This means that government agencies are not commissioning a new software project from scratch; they are adopting a pre-existing solution that has already been developed and refined.

This approach has a direct and profound impact on scalability and profitability. In a traditional bespoke model, growth is linear: each new project requires a corresponding increase in consulting and development resources, which limits the ability to scale and places pressure on margins. In contrast, cBrain's COTS model allows a single product to be sold repeatedly with minimal additional development overhead. This productization is a primary driver of the company's financial efficiency. The company's high profitability, evidenced by its 32% EBT margin in 2024, is a direct financial outcome of this strategic choice, as the majority of its costs are fixed and related to staff and development. The ability to sell the same software to multiple clients, with only minor adjustments, enables a high-margin, software-centric operation that is fundamentally more scalable than a services-heavy, project-based competitor.

The Core Product: The F2 Platform

The F2 platform is the central pillar of the entire business model. It is described as a "robust case and document management system" specifically designed for public sector organizations. The platform provides core functionalities essential for government operations, including dynamic case management, electronic document and records management, and mobile access via HTML5 and dedicated applications. For seamless integration into a client's existing IT ecosystem, the F2 platform offers a full set of open (RESTful) APIs and can integrate with common systems such as Active Directory and Exchange. Every case, document, and communication is securely stored in a shared digital archive with granular access controls and a full audit trail.

A crucial nuance of this COTS model is its emphasis on configurability rather than customization. While the F2 platform is a standardized product, it is also "easily adaptable and configurable". This capability is critical for addressing the diverse and often unique procedural requirements of different government agencies without resorting to time-consuming and expensive bespoke coding. The platform supports configurable workflows for a wide range of public sector processes, including grants, audits, and licensing. This ability to adapt the software using a "no-code" approach is a defining feature of cBrain's business model and a key reason for its market appeal. It solves a major pain point for government clients by allowing them to align the software with their specific legislative and procedural needs while avoiding the cost, risk, and time sink of traditional custom development projects.

The Value Proposition: Efficiency, Transparency, and Speed

The value proposition of cBrain’s COTS model can be summarized by three core benefits: efficiency, transparency, and speed. The efficiency gains are measurable and significant, as demonstrated by customer case studies. For instance, Rudersdal Municipality in Denmark transitioned to an "almost 100% digital service channel" using the F2 platform, which enabled them to process "70% more cases... without extra staff". The Danish Ministry of Ecclesiastical Affairs achieved a "30% reduction in processing time" for building case management. These examples illustrate how cBrain's software directly improves administrative productivity and reduces the burden of manual, paper-based processes.

Beyond efficiency, the platform enhances transparency and accountability, which are paramount in public administration. The secure, shared digital archive and full audit trail for every action ensure that decisions and information are traceable and compliant with public sector requirements. This feature supports transparency reporting and ensures that the right individuals have the correct level of access to information based on their roles.

Finally, the company's core promise is to "close the time gap from political decision to execution". By using a standardized, configurable platform, cBrain enables political or managerial decisions to be executed in "weeks instead of months or years," which is a powerful differentiator in a sector known for slow and bureaucratic implementation. This capability directly addresses a critical need for government agencies to respond quickly and effectively to new mandates and citizen demands.

III. Product Portfolio and Strategic Verticals

The Digital Process Library

cBrain's business model extends beyond a single platform to a rich portfolio of solutions. The F2 platform serves as the foundation for a "Digital Process Library" that offers "hundreds of ready-to-use solutions" for a wide range of public sector functions. This library allows cBrain to rapidly deploy solutions tailored to specific needs without starting from scratch. These standardized modules are easily adaptable to functions as diverse as human resources, legal and contract management, grants, subsidies, inspections, and audits. By productizing these solutions, cBrain can efficiently serve multiple clients with similar needs, maximizing the value of its core intellectual property and reinforcing its scalable business model.

Key Strategic Verticals

cBrain has identified and is actively pursuing leadership in specific, high-growth verticals where its COTS model can become a "category-defining standard". This strategic focus allows the company to build deep expertise and establish a dominant market position within these niches.

Paperless Ministry: This vertical is a direct replication of the highly successful model used by Danish government ministries. It is more than just a software solution; it is an exportable, proven operational model. The company leverages Denmark’s status as a global leader in e-government, a position it has held for the past eight years, according to the UN E-Government Survey, as a powerful third-party reference. In the conservative and relationship-driven B2G market, this established track record and national endorsement provide cBrain with a significant trust-based advantage when entering new territories. By establishing "beachheads in new international markets" with this proven offering, cBrain aims to secure a strong foundation for future growth and achieve global niche leadership.

Environmental Permitting: This represents a modern, high-demand vertical that leverages cBrain's expertise in a critical policy area. The F2 Environmental Permitting solution utilizes AI to "standardize and digitize environmental permitting for renewable energy projects". By significantly reducing approval times, the solution addresses a key obstacle to infrastructure development in both Europe and the United States. The Danish Environmental Protection Agency's successful use of this platform is a prime example of its impact. cBrain has been recognized as a "first-mover" in supporting new U.S. standards for environmental permitting.

The Role of AI: A Strategic Enabler

AI is not a separate product but is strategically integrated into the F2 platform to enhance its core functionalities. The platform features an "F2 AI Assistant" and "F2 AI Expert," which provide capabilities such as summarizing chats, translating documents, and giving context-aware answers based on an organization’s own data and documents. The integration of AI streamlines complex tasks and helps government employees work faster and smarter.

For government clients, the application of AI comes with significant data security and sovereignty concerns. cBrain addresses this directly by ensuring its AI operates with "full data sovereignty" and allows for on-premises deployment, which means "no data ever leaves your organization". This is a critical selling point that differentiates cBrain from competitors who may rely on third-party cloud-based AI services. Furthermore, the company has strategically partnered with IBM to test and integrate its Watson AI technology with the F2 platform. This partnership demonstrates an evolution from an earlier, purely organic growth model to a more sophisticated, capital-efficient approach. By leveraging a tech giant's expertise in AI, cBrain can offer cutting-edge features to its customers without incurring the massive research and development costs of building its own proprietary large language models, allowing it to remain a specialist in its core business while still providing advanced capabilities.

IV. Go-to-Market Strategy and Customer Relationships

The Dual Go-to-Market Approach

cBrain's go-to-market (GTM) strategy is characterized by a "dual approach" that balances stability with ambitious growth. This strategy has two distinct pillars:

Super Accounts: The first pillar involves strengthening and expanding existing relationships with its large, foundational customers, referred to as "super accounts". This provides a stable, predictable base of recurring revenue and a solid foundation from which to grow.

Global Niches: The second pillar is the active pursuit of global leadership in selected niche markets, where the F2 platform can become the industry standard. This is where the company's "Stepping Stones" initiative comes in, designed to increase contract values and win larger international projects, with a financial goal of lifting annual revenue growth to 30%.

This combined approach allows cBrain to maintain a robust and predictable core business while simultaneously investing in and developing high-growth international opportunities. The company's targeted customer segments include ministries, agencies, municipalities, and universities, demonstrating a clear focus on the public sector at all levels of governance.

International Expansion Strategy

cBrain has a clear and deliberate plan for international growth, aiming to replicate its success in Denmark on a global scale. The company has a physical presence on five continents and is actively targeting projects in key regions, including the USA, Germany, the UAE, and Africa. However, the company is transparent about the challenges inherent in this strategy. The nature of large government procurements means that revenue recognition can be influenced by "timing-related factors and market-specific delays". These delays can cause short-term revenue fluctuations, as seen in the first half of 2025, when some projects were postponed. Despite this, cBrain has maintained its full-year guidance, which indicates management's strong confidence in its international sales pipeline and its ability to close these delayed deals. This demonstrates a mature understanding of its market and a long-term perspective on growth, even if it affects short-term performance.

Partner and Ecosystem Model

A crucial component of cBrain's international expansion and GTM strategy is its collaborative approach with key partners. The company has forged strategic partnerships with organizations that can help it navigate new markets and build credibility. Examples include partnerships with the United Nations Development Programme (UNDP) to accelerate digital transformation in Africa and with Elm, a pioneer in the Saudi Arabian IT sector. These collaborations are vital for penetrating regions with different regulatory frameworks, business cultures, and government procurement processes. By leveraging the local expertise and established relationships of its partners, cBrain can more effectively and efficiently establish a foothold in new markets. This multi-faceted approach to internationalization is more sophisticated and capital-efficient than simply opening a sales office in a new country.

V. Financial Analysis of the Business Model

A comprehensive financial analysis reveals that cBrain's business model is not only scalable but also highly profitable and financially stable.

Revenue Streams and Strategic Trends

cBrain's revenue is generated from three primary sources: one-time software licenses, recurring software subscriptions, and services revenue. The company's financial reports provide a clear picture of a strategic shift in its revenue mix.

The single most important financial insight is the profound and intentional shift in the company's revenue mix. In the first half of 2025, recurring revenue from subscriptions grew by a robust 24% and came to represent 61% of total revenue, up from 47% the prior year. This trend indicates that the business is fundamentally transforming from a hybrid model to a predominantly subscription-based SaaS model. This transition leads to increased revenue predictability, higher customer lifetime value (CLV), and greater financial stability. The significant decline in one-time software licenses, while impacting short-term revenue, is a natural and expected consequence of a healthy business model maturation. It is a sign that the company is successfully locking in customers into long-term, sticky relationships that are far more valuable than one-off sales.

Profitability and Financial Health

The profitability of cBrain is a key indicator of the efficacy of its business model. The company reported a 32% EBT margin in 2024, a figure that is indicative of a highly efficient and scalable operation. This is a direct reflection of its COTS model, which relies on a product that can be sold and configured repeatedly with high margins. Furthermore, the company has a strong financial foundation, as evidenced by its positive operating cash flow of DKK 40 million in the first half of 2025 and its clean balance sheet, which contains no goodwill or loans. The company's ability to generate cash directly from operations allows it to fund its growth organically and strategically.

While the company has lowered its EBT margin forecast for 2025 to 18-23%, this is not a symptom of financial distress but rather a deliberate and strategic decision. The company explicitly states that it allocated DKK 30 million at the beginning of the year to support organizational development and market investments for its long-term growth plan. The lower margin is therefore a planned capital allocation to fund future expansion and should be viewed as a strategic investment rather than a decline in core profitability.

VI. Competitive Landscape and Market Positioning

cBrain operates in a dynamic and competitive market with both large, legacy players and modern, niche-focused companies. Its business model and strategic positioning must be understood in the context of this landscape.

Analysis of Key Competitors

Tyler Technologies: Tyler Technologies is the dominant public sector software provider in the United States, with an immense scale and market penetration, serving over 13,000 government locations with 45,000 installations. Like cBrain, Tyler has successfully shifted to a high-margin recurring revenue model, with over 80% of its revenue coming from subscriptions and maintenance. However, while cBrain's strategy is based on productizing deep, niche expertise, Tyler's is based on acquiring a broad range of products and integrating them into a comprehensive ecosystem. This makes Tyler a formidable competitor due to its sheer size and extensive installed base.

KMD: As a large Danish IT services and software company, KMD is a direct competitor to cBrain in its home market. KMD's business model is broader and more diversified, providing a wide range of services and solutions across various sectors. While KMD also develops and delivers case and document handling software (e.g., the WorkZone product suite), its multi-faceted approach and reliance on subsidiaries indicate a different strategic focus than cBrain's concentrated, COTS-centric model.

Objective Corporation: Based in Australia, Objective Corporation represents a direct and modern competitor with a business model that mirrors cBrain's in key ways. Objective also provides a specialized SaaS platform for government regulators and emphasizes a "configure instead of customise" approach using a "low-code and no-code" framework. This similarity in strategy indicates that the "configurable COTS" model is a shared vision for the future of GovTech, with companies like Objective and cBrain pursuing it independently in different geographic markets.

Competitive Advantages

cBrain has several distinct advantages that differentiate it from its competitors and protect its market position. The primary advantage is its pioneering COTS model for government, which offers a superior value proposition in terms of speed, cost-effectiveness, and risk mitigation compared to bespoke projects.

A second, highly valuable asset is its proven track record. The company's success in Denmark and the country's consistent #1 ranking in the UN E-Government Survey provide an invaluable, hard-to-replicate asset. This serves as a powerful reference that builds trust with foreign governments, which are inherently risk-averse, and helps to validate cBrain's model on the world stage.

Finally, cBrain's targeted focus on high-demand verticals positions it as a deep expert in specific, complex domains. While competitors like Tyler may offer a broader range of solutions, cBrain's specialization in areas like "Paperless Ministry" and "Environmental Permitting" allows it to build and maintain a leadership position in these niches, where its expertise provides a strong competitive edge.

Barriers to Entry and Switching Costs

The public sector software market is characterized by significant barriers to entry and exceptionally high switching costs. The sales cycle is long and requires building trust and relationships with government officials. Once a core system for case and document management is in place, the cost and complexity of replacing it are immense. This is due to the difficulty of migrating vast amounts of data, the need to retrain a large workforce, and the critical importance of ensuring the continuity of essential public services. These factors create a powerful economic moat for established players like cBrain. The high switching costs ensure customer loyalty and provide a stable foundation for long-term recurring revenue, which is a key component of the business model.

VII. Strategic Outlook, Opportunities, and Risks

Growth Opportunities

cBrain is strategically positioned to capitalize on several significant growth opportunities. The most powerful macro driver is the accelerating global shift among governments towards standardized COTS solutions to modernize their operations efficiently. The F2 platform's model is perfectly aligned with this trend.

The company's planned international expansion represents a vast, largely untapped market for its niche solutions. By focusing its efforts on key regions like the USA, Germany, the UAE, and Africa, cBrain can apply its proven model to new territories. The continued development of new, high-demand vertical solutions, such as those related to climate action and environmental permitting, will open up new revenue streams and strengthen the core product. The strategic integration of AI, done in a secure and data-sovereign manner, further solidifies its position as a modern, forward-thinking leader in the GovTech space.

Potential Risks

Despite its strong position, cBrain's business model is subject to certain risks. The reliance on winning large government contracts makes the company's financial performance susceptible to "timing-related factors and market-specific delays" in procurement. This can lead to significant quarter-to-quarter revenue volatility, which is a known risk for investors.

Competition also presents a constant challenge. While cBrain has a strong niche position, it must navigate the presence of larger, well-funded competitors like Tyler Technologies and KMD, as well as agile, modern rivals like Objective Corporation. To maintain its leadership, cBrain must continue to innovate and execute flawlessly.

Finally, while the COTS model has been successful in Denmark, cBrain must prove its scalability in vastly different regulatory, legal, and cultural environments globally. The company's ability to successfully replicate its proven model across diverse international markets is critical for its long-term growth and success.

Conclusion

cBrain's business model is a powerful and scalable COTS-based alternative to traditional government IT. Its strategic pivot to a predominantly recurring revenue model, combined with its high profitability and fiscally conservative, organically-driven growth, provides a strong financial foundation. The company’s ability to leverage its proven track record in Denmark as a powerful exportable asset and its focused, niche-based international expansion strategy positions it to capitalize on the global trend towards efficient digital governance. While short-term volatility from project delays remains a factor, the company's long-term strategic direction and the high switching costs of its installed base indicate a business model built for sustained success and market leadership.

Thanks for reading!

Stiliyan Loukanov, Feather Fund

Open an account with Interactive Brokers:

https://ibkr.com/referral/stiliyan756

Sign up to Revolut with the link below to support the blog:

ttps://revolut.com/referral/?referral-code=stiliyujwu!MAY1-24-AR

Open an account with eToro to support the blog:

Disclaimer: The information presented here, including ideas, opinions, views, predictions, forecasts, commentaries, or suggestions, whether explicitly stated or implied, is intended purely for informational, entertainment, or educational purposes. None of the content should be interpreted as personalized investment or financial advice. Although every effort has been made to ensure the accuracy of the information provided, errors or inaccuracies may be present. Always exercise caution and seek professional financial advice before making any investment decisions.